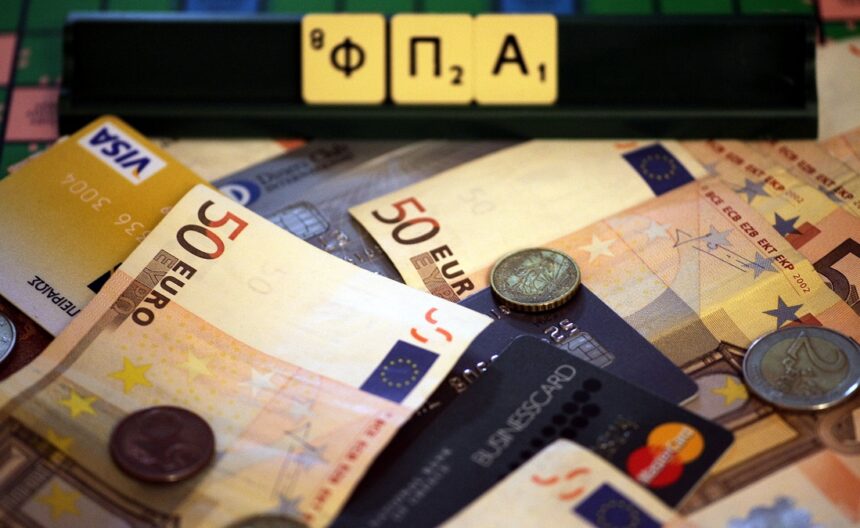

The pre-filling of income – expenses is mandatory from 1/1/2024

In mandatory prefilling income, expenses and corresponding taxes in the relevant codes of the tables of the VAT declaration it proceeds Ministry of National Economy and Finance and the AADEwith the aim of facilitating businesses in the fulfillment of their tax obligations, but also to ensure the fulfillment of the relevant obligations.

Pre-filling is done based on the data transmitted to myDATA and their accounting characterization by companies liable for declaration for VAT returns submitted from 1.1.2024 onwards.

The procedure that businesses will follow during submission of a VAT return determined by a Decision of the Deputy Minister of National Economy and Finance, Haris Theoharis after a recommendation from the Governor of the Independent Public Revenue Authority, George A splash.

The decision clarifies that prefilling the fields:

• is now binding for businesses when submitting their VAT return,

• it is based on the data transmitted to the digital platform myDATA of AADE and their accounting characterization by the companies liable to make a declaration for the VAT returns submitted from 1.1.2024 onwards and concerning tax periods from 1.1.2024 onwards,

• ensures the basic rule that income cannot be less and expenses cannot be more than what is transmitted to the myDATA digital platform, with the possibility of deviating from the income-expense rule up to a deviation rate of 30% separately for income and expenses. The deviation rate will be reviewed in the coming months, with the aim of its gradual reduction and eventual zero.

Furthermore, with the aim of dealing with objective data correlation difficulties that reduce revenues or increase expenses respectively, an alternative way of transmitting the data, for which this inability exists, is foreseen, so that the VAT returns agree with the data transmitted to the myDATA platform .

In particular, when submitting VAT returns by businesses, from 01.01.2024 onwards, the following are foreseen:

Income – Outflow VAT

• It is allowed to transfer amounts from an output code to another output code with a 0% VAT category.

• Allowed to submit more income than has been submitted to myDATA.

• In case of objective difficulty in correcting income, it is permitted to use an alternative way of pre-filling with Document Type 11.4 – Retail Credit Item marked “Accounting Entry” and a distinct reference in the comments marked “Association Difficulty”.

Expenditures – Inputs VAT

• The transfer of amounts from one input code to another input code is allowed for all categories of expenses.

• Allowed to submit less expenses than what has been submitted to myDATA.

• In case of objective difficulty in transmitting expenses, it is permitted to use an alternative way of pre-filling with Document Type 14.30 – Entity Documents as Inscribed by itself (Positive) and a distinct reference in the comments marked “Association Difficulty”.

• Post-date declaration of expenses is permitted and systematically monitored, in a subsequent VAT tax period from the one corresponding to the date of issuance of the corresponding documents and appearing in myDATA, but within the year they relate to.

Furthermore, to make it easier to understand the pre-completion of the VAT return per tax period and to identify any inconsistencies with the data held by businesses, from today the myDATA platform provides the possibility of retrieving files for each tax period, where, per transmitted document, the values prefilled for it in the output and input codes. The new service of the myDATA platform is called “Analysis for Prefilling VAT”.